Stablecoins: Boring, Safe and Kinda Brilliant

Boring is Good

At a Glance: On Friday, President Trump signed the “GENIUS” act into law, paving the way for stablecoins in the U.S. market. Stablecoins are a safe digital currency whose value is pegged to the U.S. dollar. The currency has advantages over credit cards including immediate processing and lower fees. Expect rapid adoption by banks, merchants and payment platforms over the next two years.

Crypto’s Troubled Past

In November 2022 a leaked balance sheet revealed that cryptocurrency exchange FTX had secretly sent customer funds to its sister firm Alameda Research, who lost them in risky trades. The exchange collapsed, forcing several firms into bankruptcy, affecting 15 million customers and over $30 Billion in assets.

FTX founder Sam Bankman-Fried was convicted of fraud and sentenced to 25 years in jail. His fall from grace shocked the industry: he had been seen as crypto’s “white knight”, meeting with politicians, pledging fortunes to charity and touting his exchange as the most regulated in the industry.

FTX’s collapse was called the “dotcom bust moment” for crypto. Bitcoin’s price fell by 75% and consumers recoiled from an industry seen as the wild west. There was a silver lining, however: congress held a series of hearings that laid the groundwork for the GENIUS act.

A Stablecoin is What Exactly?

Cryptocurrency is different from traditional currency in three ways: 1) it is entirely digital, 2) it uses encryption (known as cryptography) for security and 3) it operates on a decentralized system called a blockchain instead of being controlled by a government or bank.

Bitcoin was crypto’s original product, designed as a peer-to-peer electronic cash system, allowing people to exchange money online without a middleman. While a promising concept, bitcoin is rarely used for everyday payments and perceived mostly as an investment or black-market currency.

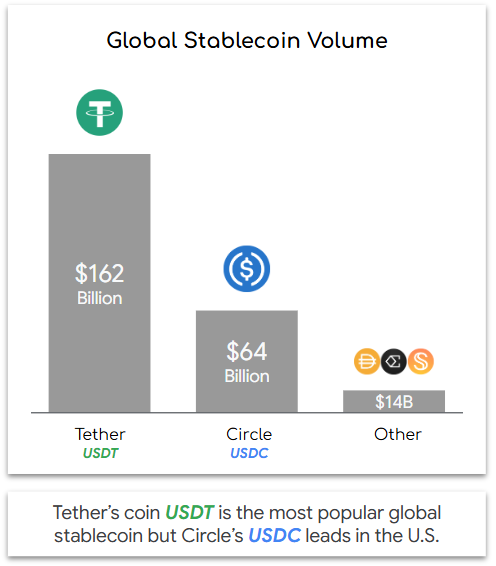

Stablecoins are a special type of digital currency designed to reduce volatility by pegging to a real asset. For example, a US Dollar-backed stablecoin should always be worth $1. The most popular stablecoins like Tether’s USDT and Circle’s USDC back customer assets with real dollar holdings.

Hey Genius

The Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act requires issuers to obtain a license and meet key requirements:

Fully back their coins with an equal value of real dollars or U.S. Treasury bills.

Provide monthly disclosures of reserves to prove their holdings are real.

Comply with financial guidelines regarding sanctions and anti-money laundering.

The act provides clarity to issuers, merchants and users, paving the way for widespread adoption. It is expected to make the U.S. the market leader in crypto and reinforce the dollar as the world’s leading currency.

What’s So Great About Stablecoins?

Stablecoins have exploded in popularity in emerging markets like Latin America and Asia because of their benefits.

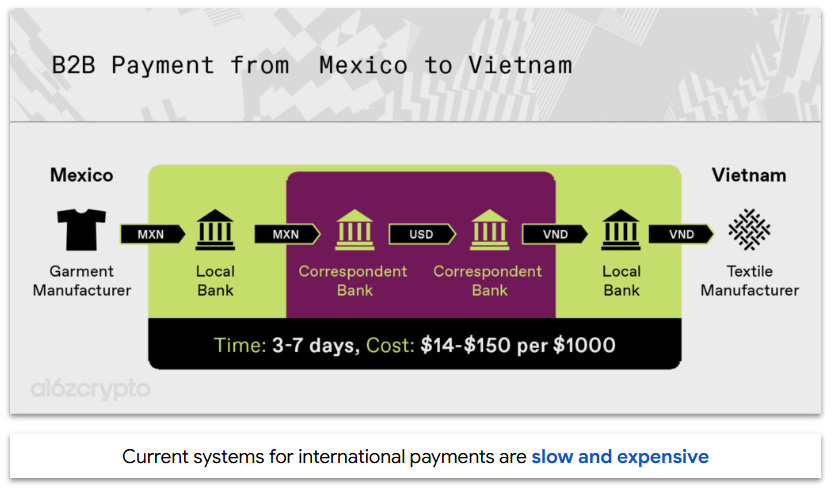

For consumers, transfers move faster and cheaper than traditional methods. For example, sending $1,000 from Mexico to Vietnam passes through 5 intermediaries, taking up to 7 days and $150. The same transfer happens instantly and nearly free via stablecoin. Stablecoins are well…stable: unlike emerging market currencies, when you own a stablecoin you know it’s worth a dollar.

For businesses, stablecoins give a cost advantage over credit cards with processing fees as high as 3.5%. A grocery store owner with a 2% sales margin could double their profits by eliminating credit card fees! This is especially valuable for small business owners who lack the clout to bargain for better terms.

When AIs Start Spending

AI agents are expected to be heavy users of stablecoins, as they can be programmed to transact without human intervention. Imagine giving your AI assistant $500 in stablecoins to book a flight without accessing your credit card. Self-driving robotaxis could use coins to pay for tolls, parking or charging and allocate a portion of the cost to each rider.

Stablecoins are expected to be a key tool for AI companies to pay content providers for training data. AI companies crawl millions of sites a day, a scale that makes payments impossible. Stablecoins would enable bots to issue “micropayments” each time they visit a site, unlocking a content economy.

This isn’t without risk. Developers will need to build controls and oversight to prevent AIs from overspending or falling prey to hackers.

What to Watch For

Expect a wave of new stablecoin offerings over the next 12-24 months as merchants encourage shoppers to pay with them and banks compete to be your digital wallet. Even non-traditional players like Amazon, Epic Games and YouTube may launch their own coins for in-app payments.

As with any new product, shop around for the best deal and make sure you trust the company. The GENIUS act adds new protections but deposits aren’t FDIC-insured like a checking or savings account.

My Take: Boring is Good

Okay, so let’s be real: Faster payments, price discounts, no foreign transaction fees are a bit of a yawner…nice but not game-changing. But that’s maybe the best feature of this new wave of stablecoins.

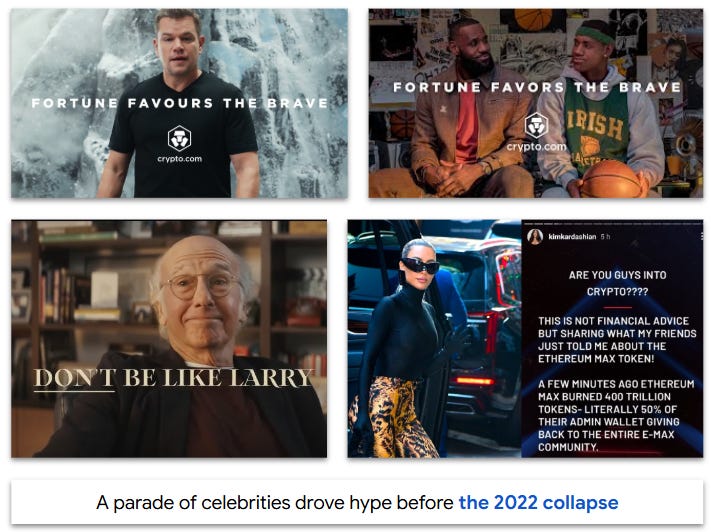

The 2022 crypto bust featured a ridiculous amount of hype. Matt Damon and LeBron James told us “Fortune favors the brave”, Kim Kardashian asked “Are you guys into crypto?” and a superbowl ad mocked a skeptical Larry David, closing with the tagline “Don’t be like Larry”.

Most people want their money to be safe, secure, without worrying about scandals. Stablecoins offer a refreshingly dull way to enter a new age of digital currency.

Dad Joke: Where do Irish Zombies keep their stablecoins? In a “Crypt O’currency” 🤣