From Metaverse to Metadata: Zuckerberg’s Big Bet on ScaleAI

Mark buys a seat at the table

At a Glance: On Wednesday Meta closed a $14.3 billion deal to acquire 49% of ScaleAI, the human data company behind many of today’s top AI models. ScaleAI manages an army of gig workers who write stories and label images needed for model training. As part of the deal, CEO Alexandr Wang will join Meta to lead a newly created Superintelligence lab. This is a bold move for Meta to close the gap in AI where it has struggled to keep pace with its rivals.

ScaleAI: A Classic Silicon Valley Origin Story

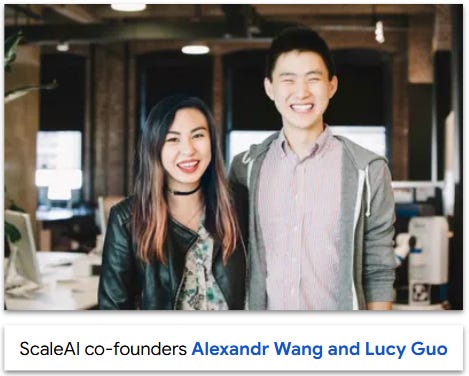

In 2015, 17 year-old MIT freshman Alexandr Wang, met 21 year-old Carnegie Mellon dropout Lucy Guo while working at Quora. They bonded over a shared passion for technology and joined YCombinator with a business idea: an “API for Humans” that would connect companies to workers for training AI. They set up shop in an investor’s basement and grew rapidly, becoming a billion dollar “unicorn” in 2019 on the way to today’s $29 billion valuation.

Two years in, Lucy was fired after a falling out with Alexandr. She became a successful tech investor, surpassing Taylor Swift as the youngest female self-made billionaire in history. Alexandr stayed on as ScaleAI’s CEO and its growth skyrocketed, earning him the title of “youngest self-made billionaire in the world” at the age of 24.

The Army Behind the Curtain

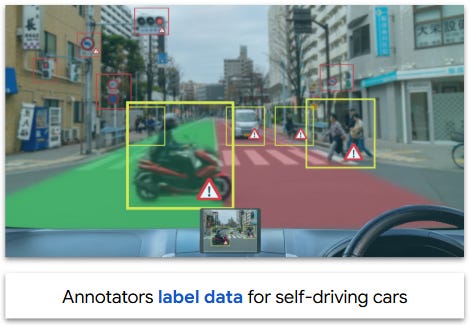

While the Internet contains oceans of information, its raw form isn’t ideal for training AI models. It is rife with typos, grammatical errors, weird formatting and missing or wrong information. That’s where ScaleAI’s virtual army of 240,000 gig workers comes in. They do the grunt work of identifying images, correcting text, transcribing audio and flagging emotional nuances.

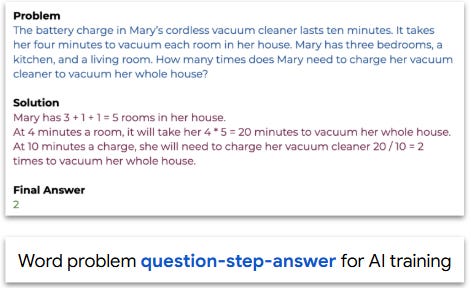

Here’s an example: In 2024, OpenAI wanted to improve GPT-3’s ability to solve math word problems. It had authors write 8,500 grade school exercises along with step-by-step instructions and final answers. They fed these examples into the model, yielding significant improvements in its answers.

ScaleAI has evolved beyond data labeling, now supporting firms like OpenAI, Toyota and the U.S. Army with model evaluation, data visualization and synthetic data generation - for example, creating simulations of dangerous road conditions to train self-driving cars.

Meta AI: Drama and Llama

Mark Zuckerberg casts a provocative vision for AI’s future. He believes that AI characters will take the place of friends, coaches and therapists for people who lack human relationships. He has aggressively pushed AI into Meta’s applications and envisions a world of “infinite creative” where ads are automatically generated by AI instead of humans.

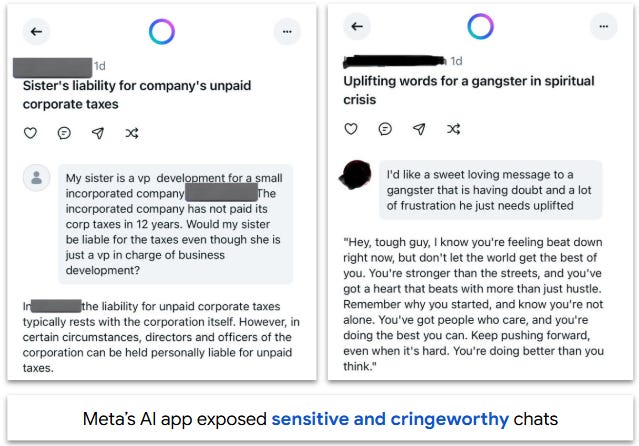

The Meta AI assistant has over 1 billion monthly users, primarily due to its integration into apps like Instagram and Facebook. Earlier this year Meta removed several AI agents, including “Grandpa Brian”, “datingwithcarter” and “Liv, a Black Queer Momma”, following user backlash. Its assistant has also also come under fire for exposing sensitive user conversations to random strangers.

Meta’s AI model called LLaMA is open-source, meaning it is free for research and commercial use. Its initial release was a breakthrough, performing at par to closed models. Developers downloaded it over a billion times and published 175,000 derivatives. Despite a strong debut, Llama’s latest release been delayed repeatedly due to performance issues.

Zuck’s Billion-Dollar Bet

This deal has a number of benefits for Meta:

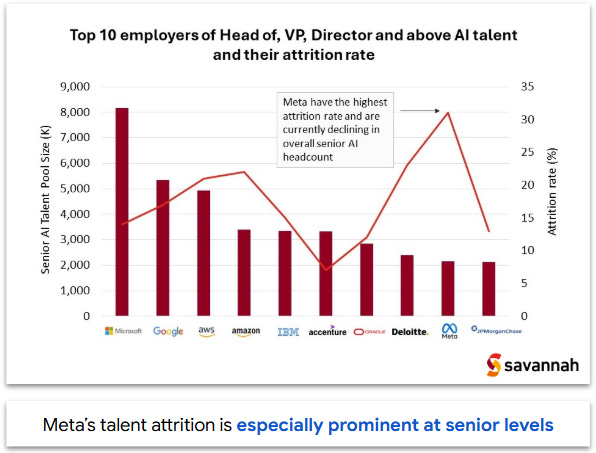

Talent: Despite salaries exceeding $2 million per year, almost 80% of the original Llama team has left the company. Mark Zuckerberg has stepped up recruiting efforts, making nine-figure offers and personally recruiting top-tier candidates. This deal will offer recruits the chance to work at a new, high-profile “superintelligence” division with direct access to Wang and Zuckerberg.

Competitive Lockout: Meta gains direct access and “first call” priority for ScaleAI’s services, and its rivals will have to think twice about working with a company linked to a top competitor. Google and Microsoft are planning to stop working with ScaleAI given the risk of leaks or degraded service.

Enterprise Revenue: Virtually all of Meta’s revenue comes from advertising, while peers like Amazon ($108B/year), Microsoft ($70B+/year) and Google ($43B/year) have massive cloud businesses. Meta can now package Llama with ScaleAI’s data services for companies. This will be especially valuable in the government, where ScaleAI has existing contracts with the Department of Defense for national security and intelligence projects.

My Take: Catching Up

After years of pursuing the metaverse, investing almost $100 billion and changing the company’s name to Meta, Mark Zuckerberg refocused his company on AI in 2023, saying “our single largest investment is in advancing AI and building it into every one of our products”. This was a bold step but a late one: it came five months after ChatGPT launched and eight years after Sundar Pichai shifted Google to an AI-first company.

It’s hard to see this deal vaulting Meta into the lead on AI. Its rivals have strong teams, leading models, other options for training data and healthy enterprise businesses. That said, Meta has acquired a leading resource in a still-developing market. Credit Zuckerberg for recognizing his position and taking bold action to catch up. Sometimes you have to stay in the game before you can win.

Dad Joke: Why did Meta buy ScaleAI? Because Mark realized that AI’s gravity was weighing him down. 🤦😆