Are We in an AI Bubble? The $400 Billion Question

Beyond the clickbait

At a Glance: Anxiety about an AI bubble peaked last week after a flawed study claimed “95% of AI projects fail.” The reality is more nuanced: investments are massive and frothy, but AI is already delivering real value. Leaders should focus on proven use cases, disciplined bets, and understanding AI’s unique “jagged frontier”.

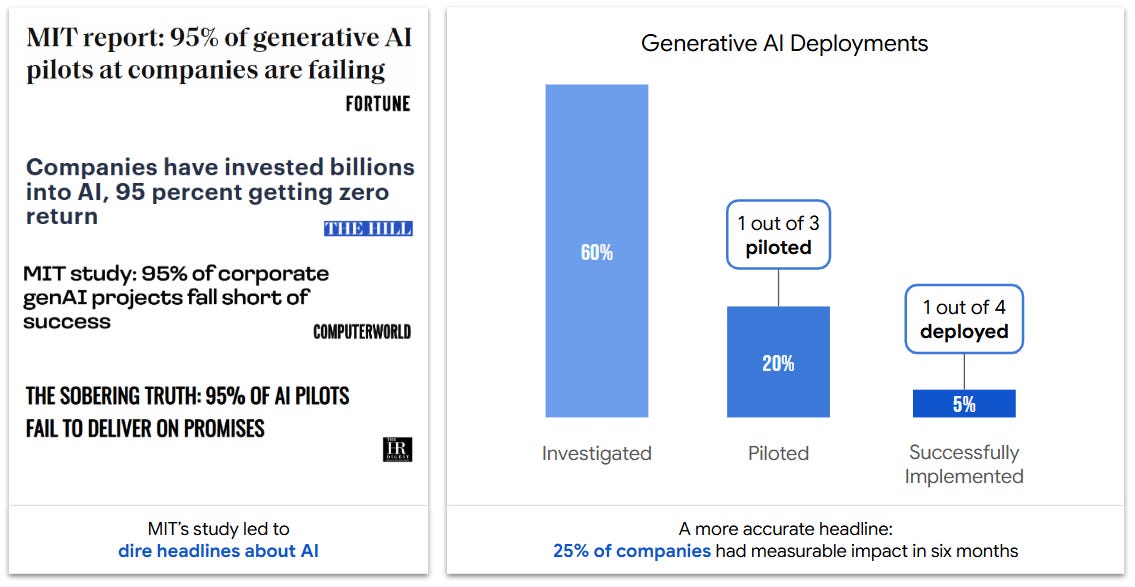

The “95% Failure” That Wasn’t

Last week, MIT researchers dropped what seemed like a bombshell, claiming that “despite $30-40 billion in enterprise investment into GenAI, 95% of organizations are getting zero return.” News outlets pounced, posting clickbait studies declaring AI overhyped and bubble-bound.

But here’s what the headlines missed: this “study” interviewed just 52 executives and set an impossibly high bar for success: Public announcements of “marked and sustained productivity and P&L impact” within six months. That’s like judging a marathon runner’s performance at mile two.

A more accurate headline using the same data would be: “25% of companies achieved measurable impact in six months”. This would be spectacular given many large-scale IT projects take years to complete.

That said, the study does touch on a real challenge: AI deployment projects aren’t simple, particularly when they lack defined success metrics or try to tackle overly complex use cases right out of the gate.

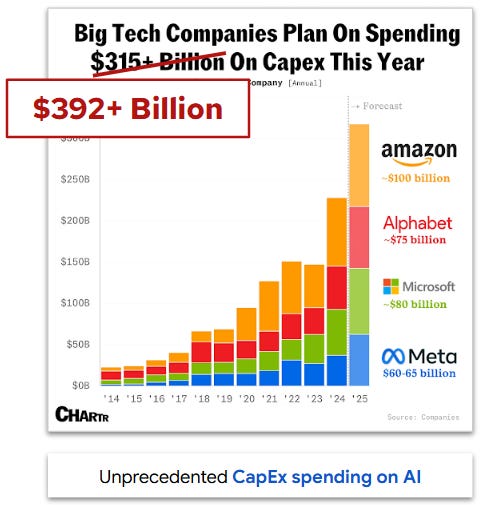

An Extra Frothy Cappuccino

The money flowing into AI is breathtaking: $392B in AI infrastructure spending this year, larger than South Africa’s GDP. In Q2 alone, AI CapEx added more to U.S. GDP growth than consumer spending.

The talent war is just as frothy. Meta has offered hundreds of millions in pay packages and reportedly floated a $1.5B offer to a single researcher. Even Sam Altman admitted: “we are in a bubble” and predicts “someone will lose a phenomenal amount of money.”

The startup scene feels like 1999: over 10,000 AI startups, with 64% of U.S. venture funding going into the sector. Firms like Safe Superintelligence ($32 Billion) and Thinking Machines ($12 Billion) hit eye-popping valuations without a product on the market.

This flood of money and talent feels unsustainable and is exactly what bubbles look like before they pop.

The Heft Behind the Hype

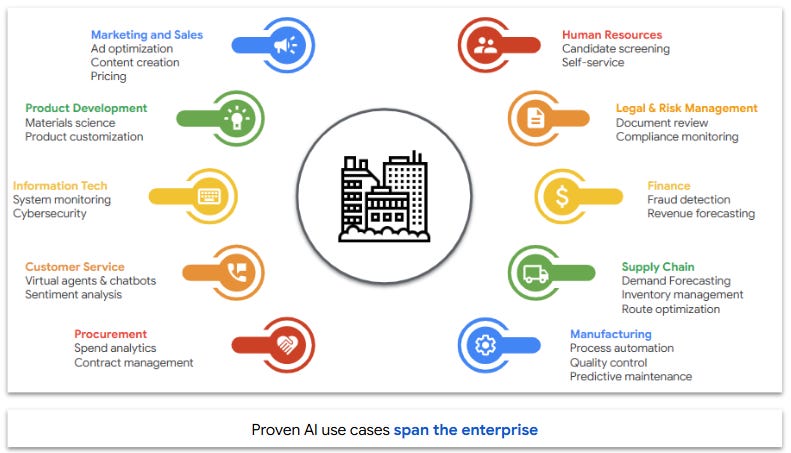

If you look past the froth, AI’s business impact is real:

Customer service: Gartner reports that 80% of companies are deploying AI chatbots. Major banks, airlines and retailers report lower costs and faster service, with 95% of decision-makers saying AI improved response times.

Software development: 84% of developers use or plan to use AI tools daily. Developers are 55% faster using GitHub Copilot, and tech giants say 20-30% of their code is AI-generated.

Contract review: Companies like Microsoft, Airbus, Mastercard, and L’Oréal all deploying solutions, with Mercedes-Benz achieving 83% faster contract turnaround.

Other functions: From resume screening, to marketing content generation, fraud detection and demand forecasting, AI now touches nearly every business function.

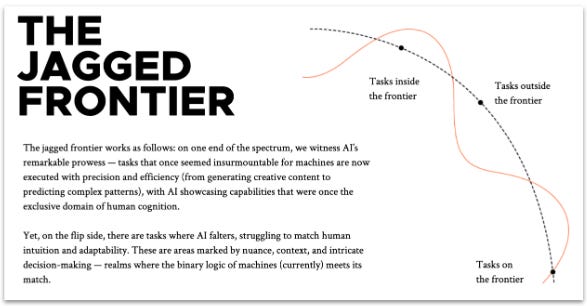

AI: Brilliant… Except When It Isn’t

Deploying AI is complicated due to an effect researchers have dubbed the “jagged frontier”. AI can write sophisticated marketing copy, debug complex code, and analyze thousands of legal documents. But ask it to count the number of R’s in “strawberry” and it might confidently tell you there are two (there are three). It can analyze sentiment in customer reviews but might hallucinate product details.

This jaggedness means you can’t just plug AI in like a printer and expect consistent results. You need to run pilots to understand what it can reliably do and where humans need to stay in the loop. It’s less like buying software and more like training a brilliant but unpredictable intern.

Beyond the technical challenges, that MIT study found “unwillingness to adopt new tools” was the biggest barrier to AI success, making it essential to invest in change management, training, and internal expertise.

Separating Winners from Wannabes

We’ve seen this movie before. The dot-com bubble created spectacular failures alongside lasting winners. Pets.com and Webvan flamed out, but Amazon, Google and Meta are now worth trillions. The internet didn’t disappear when the bubble burst, it just got more disciplined.

AI is following the same script. We’re certainly in a bubble: some valuations are nuts and there will be flameouts. But bubbles don’t invalidate revolutionary technologies; they just separate the winners from the wannabes.

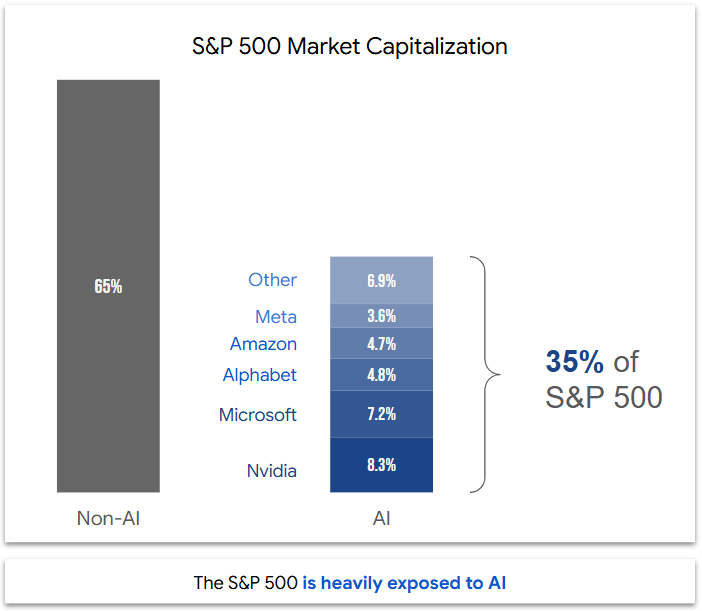

If you’re an investor: Unlike 1999, most AI startups are privately funded, so the general public isn’t directly exposed to startup carnage. But you’re still at risk, with roughly 35% of the S&P 500 consisting of companies whose success depends on AI. Make sure you’re comfortable with that concentration.

If you’re running a company: Skip the moonshots and start with proven use cases like customer service, coding, and contract review. Build internal AI expertise, set realistic timelines, and remember that success often depends more on change management than technology.

Yes, there’s froth. But start with proven use cases, invest in change management, and you’ll be on the winning side when the hype clears.

Dad Joke: Why did Google co-founder Sergey Brin come back to work on AI? Because he wanted to experience a Double Bubble. 😭